SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | |

| | ¨ | Preliminary Proxy Statement |

| | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | x | Definitive Proxy Statement |

| | ¨ | Definitive Additional Materials |

| | ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

TIVO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| | x | No fee required. |

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| | |

| 1) | Title of each class of securities to which transaction applies: |

|

| | |

| 2) | Aggregate number of securities to which transaction applies: |

|

| | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| | |

| 4) | Proposed maximum aggregate value of transaction: |

|

| | |

| | ¨ | Fee paid previously with preliminary materials. |

|

| | |

| | ¨

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| | |

| 1) | Amount Previously Paid: |

|

| | |

| 2) | Form, Schedule or Registration Statement No.: |

TIVO CORPORATION

Two Circle Star Way2160 Gold Street

San Carlos,Jose, California 9407095002

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 2017MAY 1, 2019

To Our Stockholders:

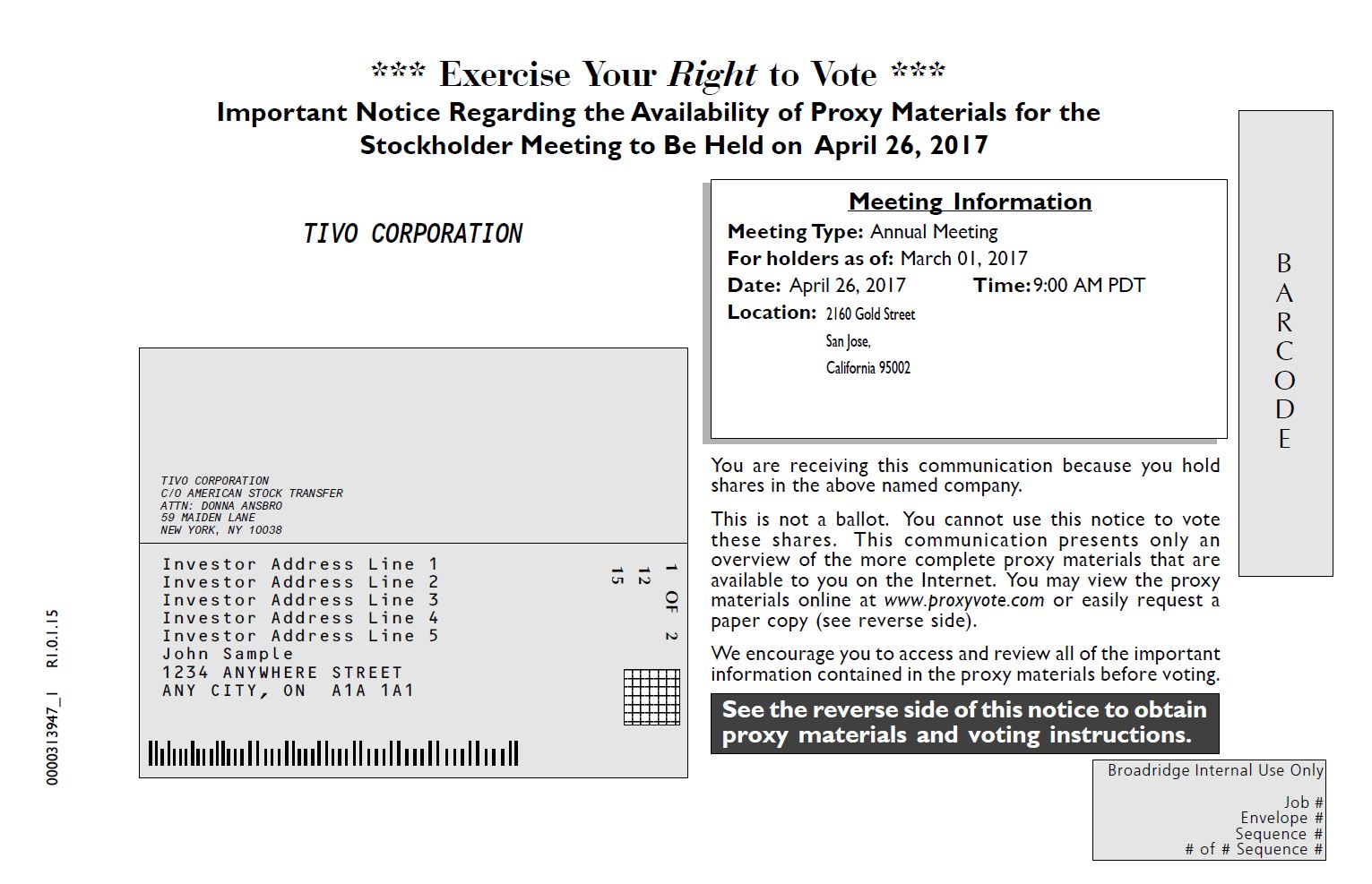

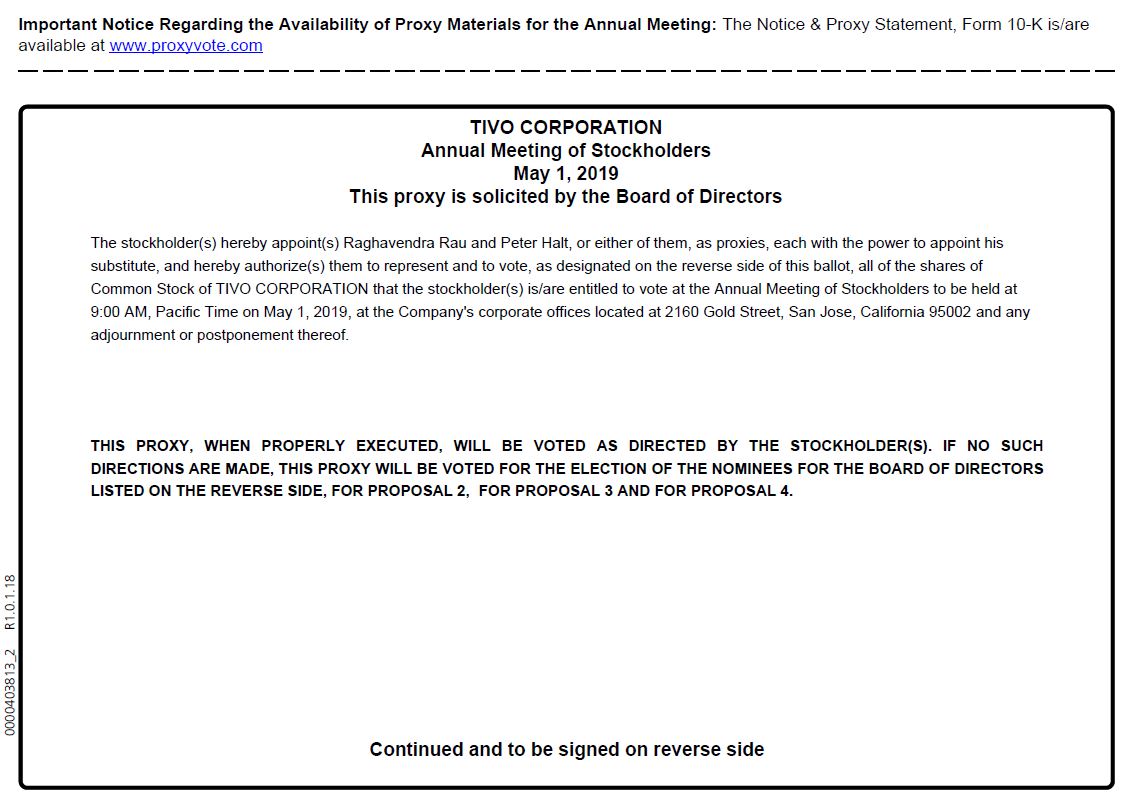

The annual meeting of stockholders of TiVo Corporation will be held at our offices located at 2160 Gold Street, San Jose, California 95002 on April 26, 2017,May 1, 2019, beginning at 9:00 a.m., local time. Directions to the annual meeting can be found at www.tivo.com. We are holding the meeting to act on the following matters:

|

| |

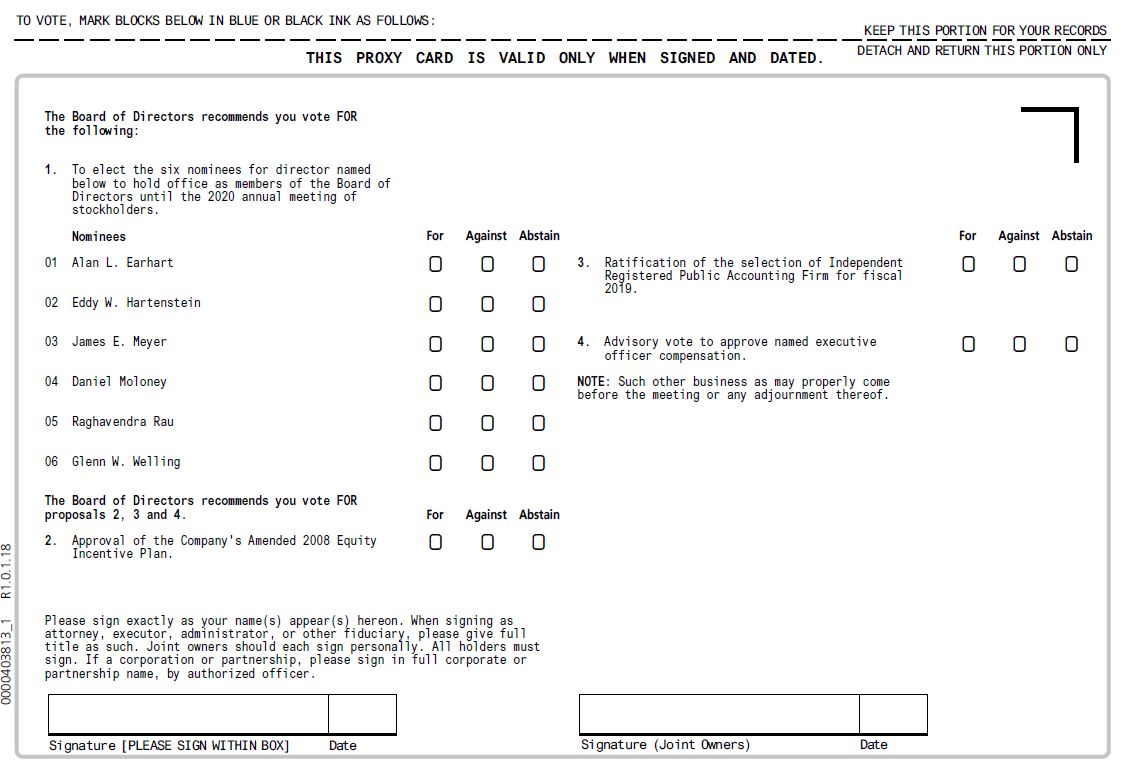

| 1) | Election of Directors.You will have the opportunity to elect eightsix members of the Board of Directors for a term of one year. The following eightsix persons are our nominees: Thomas Carson;Raghavendra Rau; Alan L. Earhart; Eddy W. Hartenstein; Jeffrey T. Hinson; James E. Meyer; Daniel Moloney; Raghavendra Rau; and Glenn W. Welling. |

|

|

| 2) | Approval of the Company’s Amended 2008 Equity Incentive Plan. You will be asked to approve an increase in the available share reserve under the Plan of 5,000,000 shares and certain other amendments to the Plan as described herein.

|

| 3) | Appointment of Independent Registered Public Accounting Firm. You will be asked to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2017.2019. |

|

|

3)4) | Advisory Vote to Approve Named Executive Officer Compensation.You will be asked for an advisory vote to approve named executive officer compensation. |

| |

4) | Advisory Vote on Frequency of Advisory Votes on Named Executive Officer Compensation. You will be asked for an advisory vote to approve how often the company should submit an advisory vote to approve named executive officer compensation.

|

| |

| 5) | Advisory Vote to Approve Transfer Restrictions in the Company’s Amended and Restated Certificate of Incorporation. You will be asked for an advisory vote to approve the transfer restrictions set forth in Article X of the company’s Amended and Restated Certificate of Incorporation.

|

| |

6) | Other Business. We will also transact any other business that is properly raised at the meeting. |

We cordially invite all stockholders to attend the annual meeting in person. If you were a stockholder as of the close of business on March 1, 2017,11, 2019, you are entitled to vote at the annual meeting. A list of stockholders eligible to vote at the annual meeting will be available for review during our regular business hours at our headquarters in San CarlosJose for at least ten days prior to the meeting for any purpose related to the meeting.

|

| | |

| | | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | | Thomas Carson,Raghavendra Rau, Interim President & CEO |

Dated: March 15, 201720, 2019 | | |

San Carlos,Jose, California | | |

YOUR VOTE IS IMPORTANT

We are using Securities and Exchange Commission rules that allow us to make our proxy statement and related materials available on the Internet. Accordingly, we are sending a “Notice of Internet Availability of Proxy Materials” to our stockholders of record instead of a paper proxy statement and financial statements. The rules provide us the opportunity to save money on the printing and mailing of our proxy materials and to reduce the impact of our annual meeting on the environment. We hope that you will view our annual meeting materials over the Internet if possible and convenient for you. Instructions on how to access the proxy materials over the Internet or to request a paper or email copy of our proxy materials may be found in the notice you received.

Whether or not you expect to attend the annual meeting, please make sure you vote so that your shares will be represented at the meeting. Our stockholders can vote over the Internet or by telephone as specified in the accompanying voting instructions or by completing and returning a proxy card. This will ensure the presence of a quorum at the annual meeting and save the expense and extra work of additional solicitation. Sending your proxy card will not prevent you from attending the meeting, revoking your proxy and voting your stock in person.

TABLE OF CONTENTSTable of Contents

|

| | | |

| | | Page |

|

| | | |

| PROXY STATEMENT SUMMARY | |

|

| | Annual Meeting Information | |

|

| | Annual Meeting Agenda and Voting Recommendations | |

|

| | Corporate Governance Highlights | |

|

| | | |

| PROXY STATEMENT | 4 |

|

| | |

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 4 |

|

| | Why did I receive a notice regarding the availability of proxy materials on the internet? | 14 |

|

| | What is the purpose of the annual meeting? | 14 |

|

| | Who can vote at the annual meeting? | 14 |

|

| | What is the quorum requirement for the annual meeting? | 15 |

|

| | How do I vote my shares without attending the annual meeting? | 25 |

|

| | How can I vote my shares in person at the annual meeting? | 25 |

|

| | How can I change my vote after I return my proxy? | 25 |

|

| | What proposals are scheduled to be voted on at the annual meeting? | 25 |

|

| | Will there be any other matters considered at the annual meeting? | 26 |

|

| | What vote is required for each proposal? | 26 |

|

| | What are the recommendations of the Board of Directors? | 37 |

|

| | Where can I find the voting results? | 37 |

|

| | |

| A NOTE REGARDING OUR PROXY STATEMENT | 7 |

|

| | | |

| PROPOSAL 1: ELECTION OF DIRECTORS | 8 |

|

| | Nominees for Director | 5 |

|

| Required Vote and Board Recommendation | 9 |

|

| | |

PROPOSAL 2: RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

|

| Principal Independent Registered Public Accounting Firm Fees and Services | 108 |

|

| | Required Vote and Board Recommendation | 11 |

|

| | | |

| PROPOSAL 2: APPROVAL OF THE COMPANY'S AMENDED 2008 EQUITY INCENTIVE PLAN | 12 |

|

| Summary of the Amended 2008 Equity Plan | 13 |

|

| New Plan Benefits | 20 |

|

| 2008 Equity Plan Benefits | 22 |

|

| Federal Income Tax Consequences | 22 |

|

| Other Tax Consequences | 24 |

|

| Required Vote and Board Recommendation | 24 |

|

| | |

PROPOSAL 3: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATIONRATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 25 |

|

| Principal Independent Registered Public Accounting Firm Fees and Services | 25 |

|

| Required Vote and Board Recommendation | 26 |

|

| | | |

PROPOSAL 4: ADVISORY VOTE ON FREQUENCY OF ADVISORY VOTES ONTO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | |

|

| | |

PROPOSAL 5: ADVISORY VOTE ON TRANSFER RESTRICTIONS IN AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | 27 |

|

| | | |

| INFORMATION ABOUT OUR BOARD OF DIRECTORS | 29 |

|

| | Board Leadership Structure and Risk Oversight | 1529 |

|

| | Independence of Directors | 1529 |

|

| | Departing Director | 1530 |

|

| | Meetings of the Board and Committees | 16 |

|

| Board of Directors | 16 |

|

| Audit Committee | 16 |

|

| Compensation Committee | 17 |

|

| Corporate Governance and Nominating Committee | 17 |

|

| Strategy Committee | 1730 |

|

|

| | | |

| | | Page |

|

| | Board of Directors | 31 |

|

| Audit Committee | 31 |

|

| Compensation Committee | 32 |

|

| Corporate Governance and Nominating Committee | 32 |

|

| Compensation Committee Interlocks and Insider Participation | 1832 |

|

| | Corporate Governance Materials | 1833 |

|

| | Director Nomination Process | 1833 |

|

| | Director Qualifications | 18 |

|

| Diversity Consideration | 1833 |

|

| | Identifying Nominees | 1833 |

|

| | Stockholder Nominations | 1934 |

|

| | Communications with the Board | 1934 |

|

| | | |

| AUDIT COMMITTEE REPORT | 35 |

|

| | |

| INFORMATION ABOUT OUR EXECUTIVE OFFICERS | 37 |

|

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 39 |

|

| | |

| EQUITY COMPENSATION PLAN INFORMATION | 42 |

|

| | |

SECTION 16(a)16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 43 |

|

| | |

| EXECUTIVE COMPENSATION | 44 |

|

| | Compensation Discussion and Analysis | 2744 |

|

| | Executive Summary | 2744 |

|

| | Business Transformation | 28 |

|

| 2016 Highlights | 28 |

|

| Commitment to Responsible Executive Compensation Philosophy and Practices | 29 |

|

| Compensation Committee Engagement Efforts and Actions in connection with Say-on-Pay Vote | 29 |

|

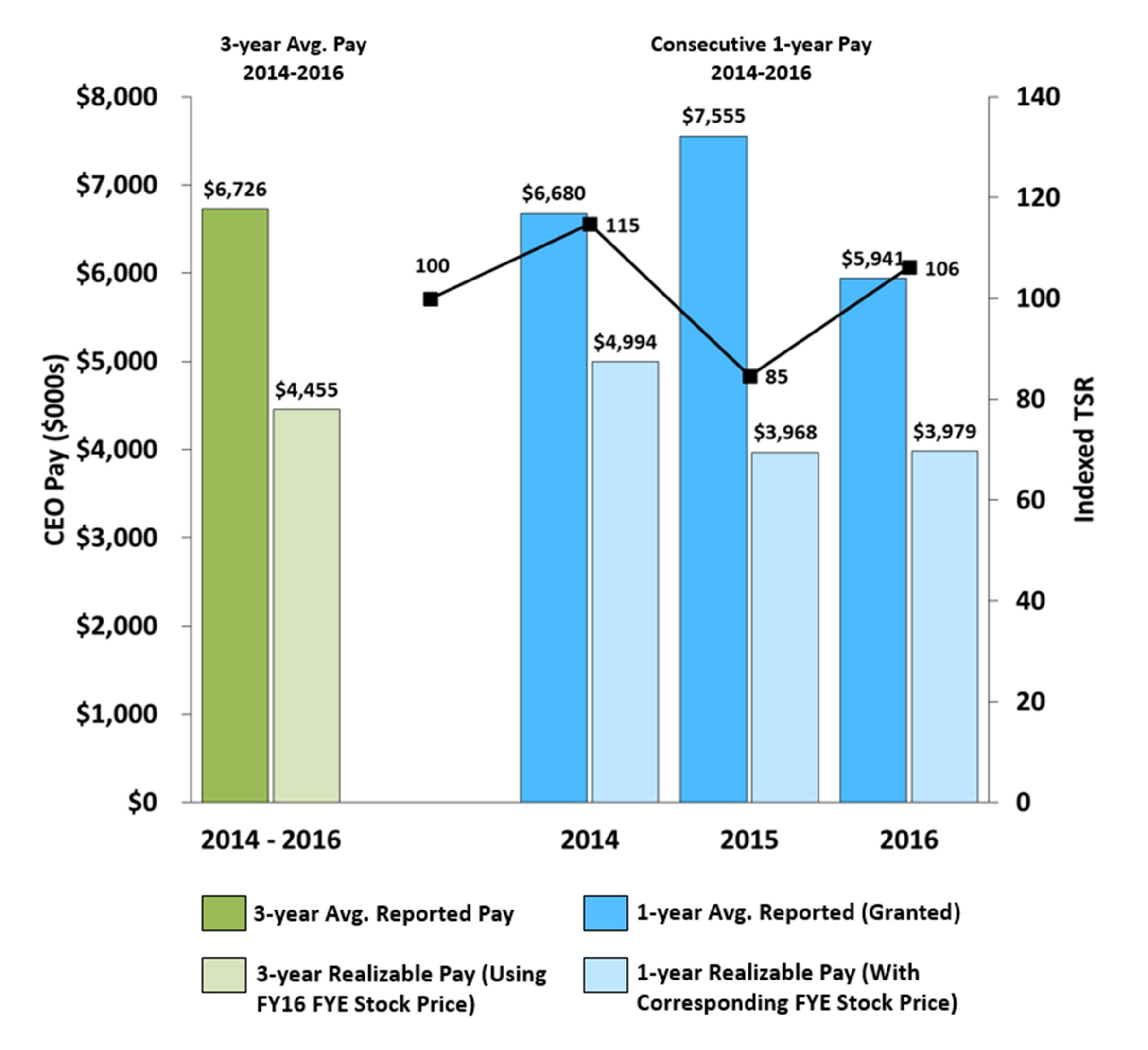

| Commitment to Pay for Performance | 31 |

|

| Chief Executive Officer’s Realizable Pay | 31 |

|

| Chief Executive Officer Reported Pay vs. Realizable Pay | 33 |

|

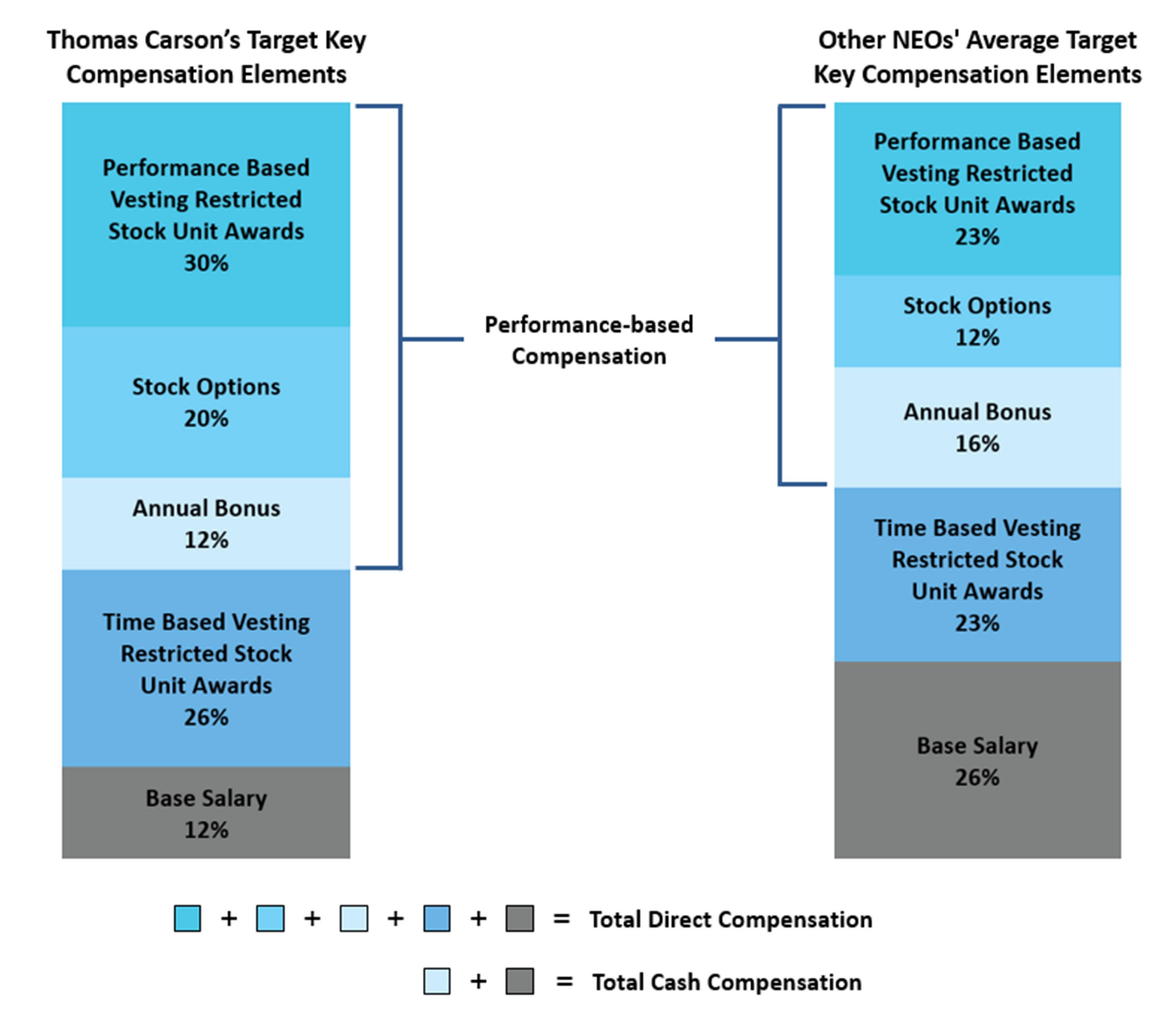

| Compensation Philosophy: Objectives, Considerations and Elements | 3450 |

|

| | Role of Our Compensation Committee | 3552 |

|

| | Role of Management in Setting Compensation | 3653 |

|

| | Role of Our Independent Compensation Consultant | 3653 |

|

| | Peer Group Determination | 3754 |

|

| | Compensation Positioning Against Peer Data and Executive Pay Survey Data | 3855 |

|

| | Reasons for Providing, and Manner of Structuring, the Key Compensation Elements in 2016 | 38 |

|

| 2016 Base Salary Decisions | 39 |

|

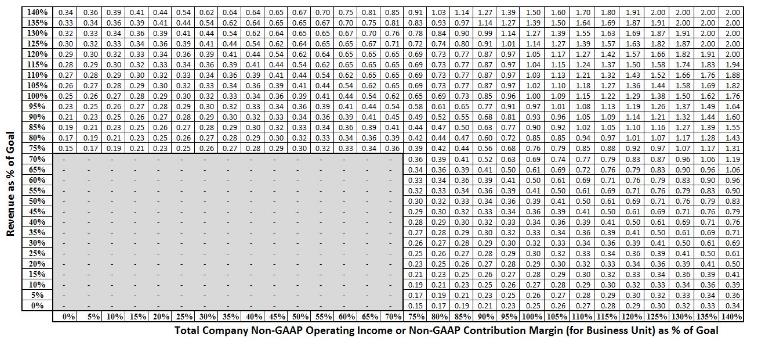

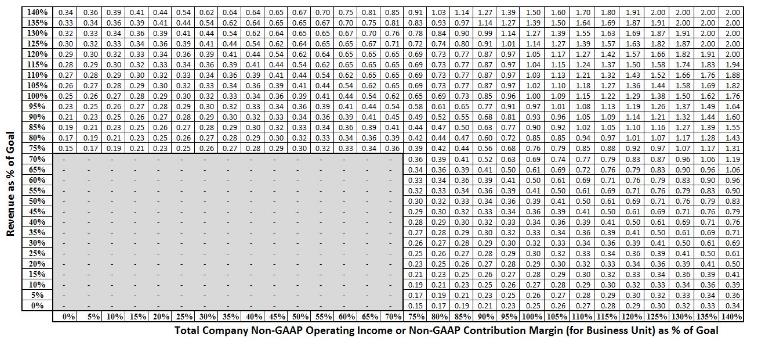

| 20162017 the Key Compensation Elements in 2018 and Description of Changes to our 2019 Short-Term Incentive Compensation DecisionsProgram | 40 |

|

| Corporate Performance Factor Matrix Used in 2016 | 42 |

|

| 2016 Long-Term Incentive Compensation Decisions | 43 |

|

| Equity Compensation Policies | 46 |

|

| Directors and Named Executive Officers Stock Ownership Guidelines | 46 |

|

| Post Year-End Compensation Decisions | 47 |

|

| Compensation Recovery Policy | 47 |

|

| Anti-Hedging Policy | 48 |

|

| Agreements Providing for Change of Control and Severance Benefits | 48 |

|

| 401(k) Plan | 49 |

|

| Other Employee Benefits | 4956 |

|

| | Tax Deductibility of Executive Compensation | 4969 |

|

| | Accounting Considerations | 4969 |

|

| | Compensation Program Risk Review | 4970 |

|

| | Compensation Committee Report | 5070 |

|

| Membership of the Compensation Committee | 70 |

|

| | |

| SUMMARY COMPENSATION TABLE | 71 |

|

| Grants of Plan-Based Awards | 73 |

|

| Discussion of Summary Compensation and Plan-Based Awards Tables | 74 |

|

| Employment Agreements with Named Executives | 74 |

|

| Outstanding Equity Awards | 78 |

|

|

| | | |

| | | Page |

|

SUMMARY COMPENSATION TABLE | |

|

| Grants of Plan-Based Awards | 52 |

|

| Discussion of Summary Compensation and Plan-Based Awards Tables | 53 |

|

| Employment Agreements with Named Executives | 53 |

|

| Outstanding Equity Awards | 55 |

|

| | Option Exercises and Stock Vested | 5779 |

|

| | Potential Payments upon Termination or Change of Control | 5780 |

|

| CEO Pay Ratio Disclosure | 82 |

|

| | | |

| DIRECTOR COMPENSATION | 84 |

|

| | Non-Employee Director Compensation Philosophy | 6084 |

|

| | Rovi (now TiVo Corporation) Non-Employee Director Compensation for Fiscal 20162018 | 6084 |

|

| | TiVo Inc. Non-Employee Director Compensation for Fiscal 2016 (Prior to the Mergers) | 61 |

|

| DIRECTOR COMPENSATION FOR FISCAL YEAR 2018 | Director Compensation for Fiscal Year 2016 | 6285 |

|

| | Employee Director Compensation for Fiscal 20162018 | 6286 |

|

| | | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 87 |

|

| | Procedures for Approval of Related Party Transactions | 6387 |

|

| | | |

| LEGAL PROCEEDINGS | 88 |

|

| | |

| ADDITIONAL INFORMATION | 89 |

|

| | |

| OTHER BUSINESS | 91 |

|

| | | |

ANNEX A - ARTICLE X OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATIONAmended 2008 Equity Incentive Plan | |

|

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting Information

|

| | |

| Time and Date: | 9:00 a.m., local time, on Wednesday, April 26, 2017May 1, 2019 |

| Place: | Offices located at 2160 Gold Street, San Jose, California 95002 |

| Record Date: | March 1, 201711, 2019 |

| Voting: | • | Stockholders as of the record date are entitled to vote. |

| | • | You can vote over the Internet or by telephone or by completing and returning a proxy card or, if you hold shares in a brokerage account in your broker’s name (in “street name”), a voting instruction form as supplied by your broker. |

| | • | See the voting instructions for Internet and telephone voting in the Notice of Availability or in the materials sent to you for more information. |

| Attending the Annual Meeting: | • | In Person: The meeting starts at 9:00 a.m. local time. You will be required to present proof of identification and stock ownership in order to attend the meeting. |

| | • | You do not need to attend the annual meeting to vote if you have submitted your proxy or otherwise voted your shares in advance of the meeting. |

Annual Meeting Agenda and Voting Recommendations

|

| | | | |

| Proposal | | Board Voting Recommendation | | Page Reference

(for more detail) |

Election of 86 directors | | For each director nominee | | 8 |

| Amendments to the Company's 2008 Equity Incentive Plan | | For | | 12 |

Ratification of Ernst & Young LLP as our independent registered public accounting firm for fiscal 20172019 | | For | | 25 |

| Advisory resolution on named executive officer compensation | | For | | |

Advisory resolution on frequency of advisory resolution on named executive officer compensation | | Select “one year” | | |

Advisory resolution on transfer restrictions | | For | | 27 |

Corporate Governance Highlights

|

| | | | |

| Governance Matter | | Summary Highlights | Page Reference

(for more detail) |

| Board Independence | | Independent nominees: 75 out of 86 Independent chairman: James E. Meyer Independent Board committees: AllAudit Committee, Compensation Committee and Corporate Governance and Nominating Committee | 29 |

|

| | | | | |

| Governance Matter | | Summary Highlights | Page Reference

(for more detail) |

| Director Elections | | Frequency: Annual Voting standard for uncontested elections: Majority of votes cast | 11 |

| Meeting Attendance | | All directors attended at least 75% of the total number of meetings of our Board of Directors and committees on which the director served in 20162018 | 1630 |

| Evaluating and Improving Board Performance | | Board evaluations: Annual

Committee evaluations: Annual

| 1632 |

| Aligning Director and Stockholder Interests | | Director stock ownership guidelines: Yes

Director equity grants: Yes

Director compensation limits: Yes

| 46 |

| 66, 84-85 |

|

PROXY STATEMENT SUMMARY |

|

| | | | |

Governance Matter | | | Summary Highlights | Page Reference

(for more detail) |

Stockholder Engagement and Executive and Director Compensation ChangesHighlights | | We are committed to ensuring our executive compensation program is effective in aligning our executive pay with our performance and our stockholders’ interests. We engage with our stockholders on our executiveOur compensation program and corporate governance and have madeincludes the following fundamental changes to our compensation program:highlights: | 3047 |

| | | • | Adjusted our 2016Our 2018 executive pay positioning philosophy downward to targettargets overall target compensation at the 50th percentile of peer data;data for decisions made in the normal course for our named executive officers other than Mr. Rau and Mr. Rodriguez; | |

| | | • | Reduced our 2016 executive pay levels to reflect this new philosophy, resulting in (i) no increases to base salary for our named executive officers in 2016; (ii) no increases in target bonuses for our named executive officers in 2016; and (iii) reduction of 2016 equity award target values ranging from 48% to 57% compared to the 2015 long-term equity incentive grants;

| |

| | • | Changed our CEO’s 2016 equity compensation mix so that performance vesting awards represent the largest component (40%) of his annual target equity award and stock options represent the smallest component (25%) of his annual target equity award; | |

| | • | IncreasedMaintained the threshold level of corporate performance goals necessary for our named executive officers to earn any annual performance bonus in 2016 to 75%2018 at 90%; | |

| | | • | To further increase the rigor of our 2019 annual performance bonus program and furtheralign our executive compensation program with our stockholders’ interests, the compensation committee (i) increased the threshold level of corporate and business group performance goals necessary for our named executive officers to earn any bonus from 90% to 95% (without a corresponding increase to payout level), (ii) reduced the maximum payout level for 2017;corporate, individual and business group performance goals from 200% to 175% (without a corresponding reduction to the level of performance goals necessary to earn the maximum payout), and (iii) for business unit leaders, increased the weighting of the corporate performance goals (from 20% to 50%) and decreased the weighting of individual goals (from 30% to 10%) and business group goals (from | |

|

| | | | | |

| Governance Matter | | Summary Highlights | Page Reference

(for more detail) |

| | | | 50% to 40%). | |

| | | • | IncreasedContinued measuring the vesting of our CEO stock ownership guideline in 2016 to 5x annual base salary and further in 2017 to 6x annual base salary; | |

| | • | Changed our long-term performance vesting awards (beginninggranted in 2015) to be measured2018 over a three-year performance period based entirely upon the achievement of two equally weighted objective performance factors (aa relative total stockholder return (“TSR”) metric and a compoundhaving those performance awards make up 50% of the 2018 annual growth rate and margin target); | |

| | • | Clarified measures and goalslong-term awards for all incentive plans in the proxy statement (beginning in 2015) to show rigor of short-term and long-term incentive targets; | |

| | • | Adopted a clawback policy beginning in 2015; | |

| | • | Eliminated the discretionary incentive elements from our seniornamed executive bonus plan beginning in 2015;officers other than Mr. Rodriguez; and | |

| | | • | Modified our peer group in both 2015 and 2016 to remove companies whose revenues and market capitalizations were too large to be appropriate for pay positioning purposes. | |

Director Compensation Changes | | We are committed to ensuring our compensation program for the non-employee members of our Board of Directors is effective in aligning pay with market metrics and is our stockholder’s interests. We have made the following key changes for our director compensation program: | |

| | • | Eliminated the automatic initial restricted stock grant under our non-employee director compensation program that previously hadMaintained a market value equal to $440,000 on the grant date, beginning with any non-employee directors joining our Board of Directors after October 2015; and | |

| | • | Added a limitation on the total annual compensation that may be paid or granted to any non-employee director for service on our Board of Directors, which was approved by our stockholders in April 2016.clawback policy since 2015. | |

TIVO CORPORATION

Two Circle Star Way2160 Gold Street

San Carlos,Jose, California 94070

95002

PROXY STATEMENT

For the

Annual Meeting of Stockholders

To be held on April 26, 2017May 1, 2019

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

The Board of Directors (sometimes referred to as the “Board”) of TiVo Corporation (sometimes referred to as the “company” or “TiVo”) is soliciting your proxy for our 20172019 annual meeting of stockholders (the “annual meeting” or “meeting”). The annual meeting will be held at our office located at 2160 Gold Street, San Jose, California 95002 on April 26, 2017,May 1, 2019, beginning at 9:00 a.m., local time. Our telephone number is (408) 562-8400.519-9100. We are first distributing this proxy statement and voting instructions on or about March 15, 2017.20, 2019.

This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the annual meeting. Please read it carefully.

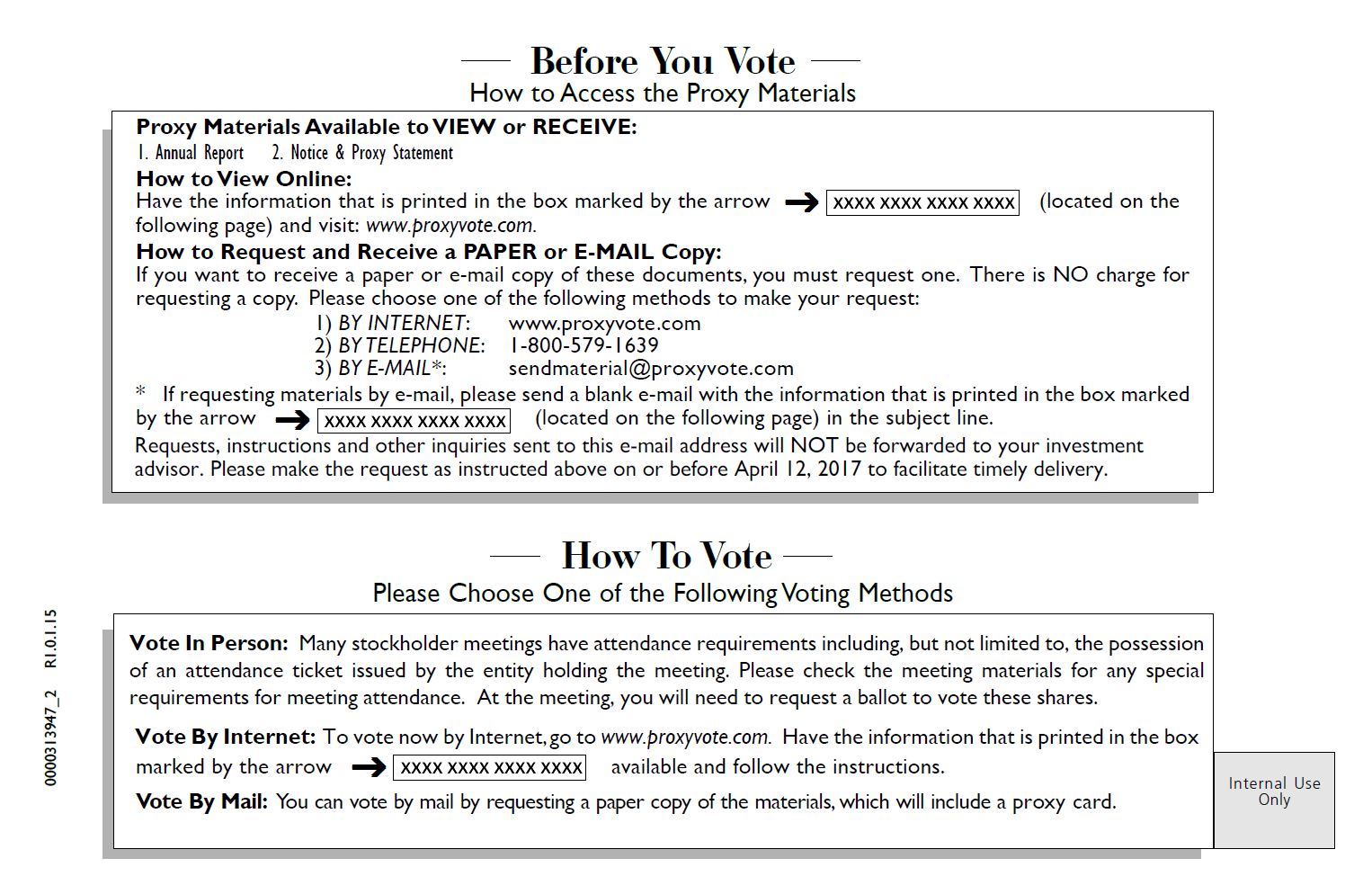

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Instead of mailing paper proxy materials, we sent a “Notice of Internet Availability of Proxy Materials” to our stockholders of record. We refer to that notice as the “Notice of Availability.” The Notice of Availability provides instructions on how to view our proxy materials over the Internet, how to vote and how to request a paper or email copy of our proxy materials. This method of providing proxy materials is permitted under rules adopted by the Securities and Exchange Commission (“SEC”). We hope that following this procedure will allow us to save money on the printing and mailing of those materials and to reduce the impact that our annual meeting has on the environment.

We intend to mail the Notice of Availability on or about March 15, 201720, 2019 to all stockholders of record entitled to vote at the annual meeting.

What is the purpose of the annual meeting?

At our annual meeting, stockholders will act upon the proposals described in this proxy statement. In addition, management will be available to discuss our performance and respond to questions from stockholders.

Who can vote at the annual meeting?

The Board of Directors set March 1, 201711, 2019 as the record date for the annual meeting. If you owned our common stock at the close of business on March 1, 2017,11, 2019, you may attend and vote at the annual meeting. You are entitled to one vote for each share of common stock that you held on the record date for all matters to be voted on at the annual meeting. As of the record date, 121,150,043124,905,466 shares of common stock, representing the same number of votes, were outstanding.

What is the quorum requirement for the annual meeting?

A majority of our outstanding shares as of the record date must be present in person or represented by proxy at the meeting in order to hold the annual meeting and conduct business. This is called a quorum. Your shares are counted as present in person or represented by proxy at the annual meeting if you are present in person at the meeting or if you have properly submitted a proxy by telephone, Internet or mail. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of votes considered to be present in person or represented by proxy at the annual meeting.

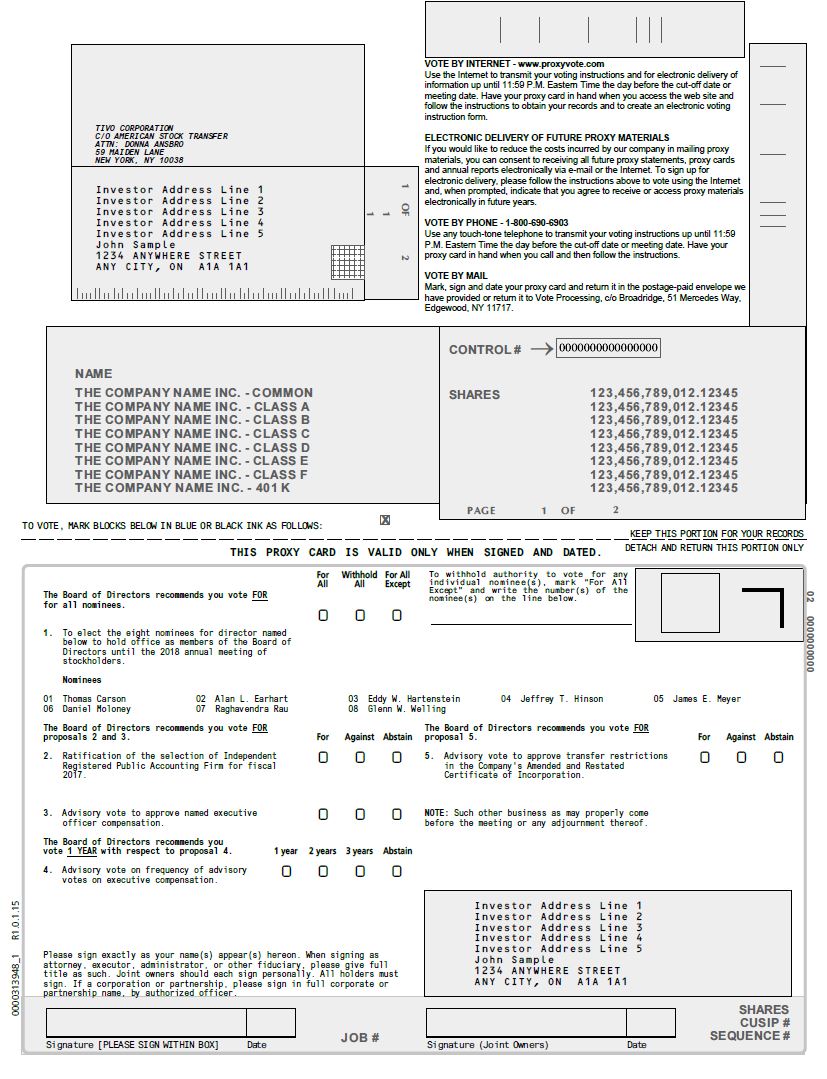

How do I vote my shares without attending the annual meeting?

You can vote over the Internet or by telephone or by completing and returning a proxy card or, if you hold shares in a brokerage account in your broker’s name (in “street name”), a voting instruction form as supplied by your broker. Voting instructions for Internet and telephone voting can be found in the Notice of Availability or in the materials sent to you. The Internet and telephone voting facilities will close at 11:59 p.m. Eastern time on April 25, 2017.30, 2019.

Please be aware that if you vote over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible.

How can I vote my shares in person at the annual meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to attend the meeting in person, please bring proof of identification to the meeting. If you hold your shares in street name, your broker will forward these proxy materials to you. If you hold your shares in street name, you have the right to direct your broker on how to vote the shares, but you may not vote these shares in person at the annual meeting unless you bring an account statement and a letter of authorization from the broker that holds your shares to the meeting.

How can I change my vote after I return my proxy?

You may revoke your proxy (including any Internet or telephone vote) and change your vote at any time before the final vote at the meeting. You may do this by submitting a new proxy at a later date or by attending the meeting and voting in person. Attending the meeting will not revoke your proxy unless you specifically request it. Only the latest validly executed proxy that you submit will be counted.

What proposals are scheduled to be voted on at the annual meeting?

The following proposals are scheduled for a vote at the annual meeting:

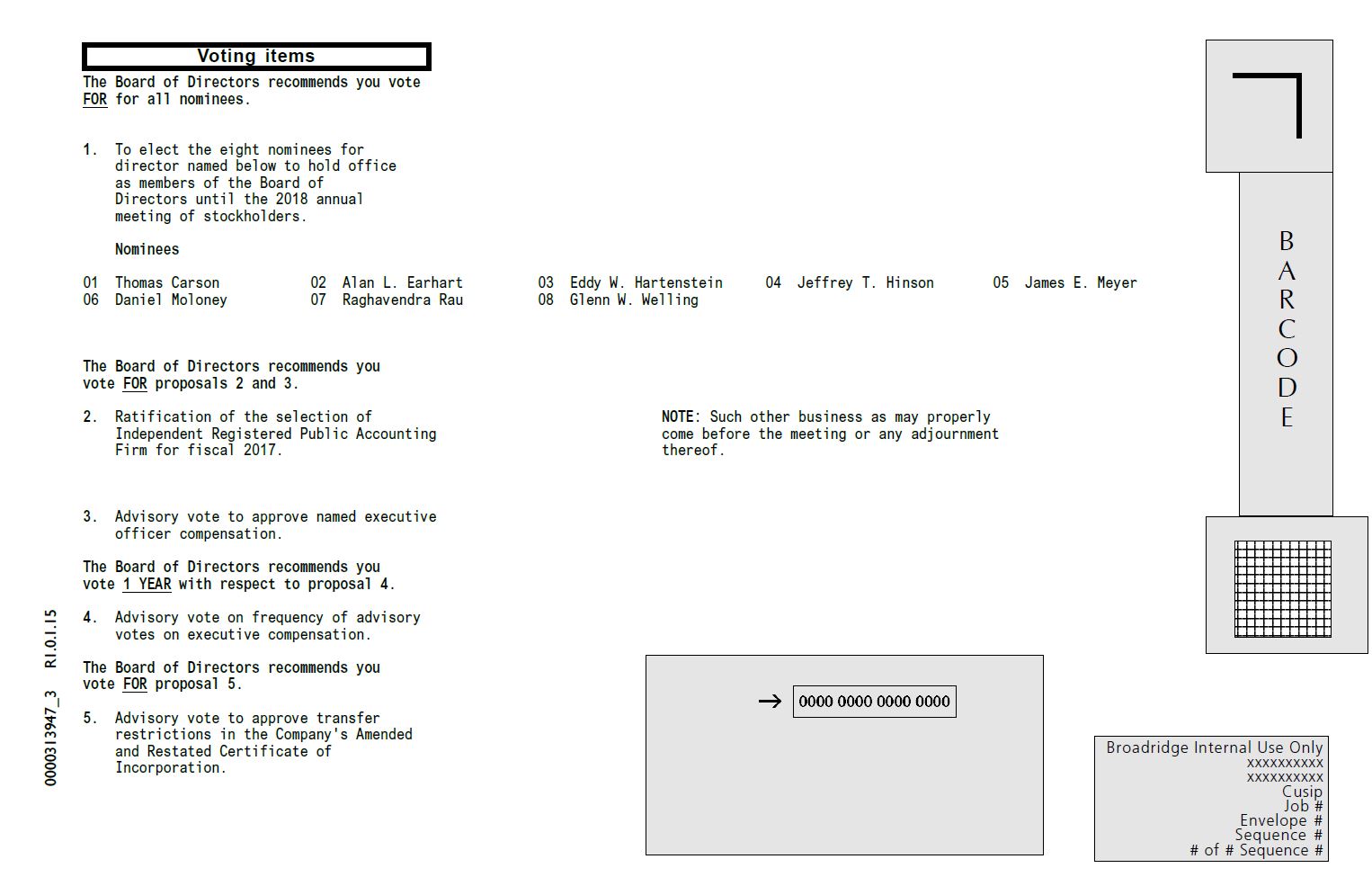

Proposal No. 1: the election of each of the named nominees for director;

Proposal No. 2: the amendments to the Company's 2008 Equity Incentive Plan;

Proposal No. 3: the ratification of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2017;2019; and

Proposal No. 3:4: the advisory vote to approve named executive officer compensation;compensation.

Proposal No. 4: the advisory vote on the frequency of the advisory vote to approve named executive officer compensation; and

Proposal No. 5: the advisory vote to approve the transfer restrictions in the company’s Amended and Restated Certificate of Incorporation.5

Will there be any other matters considered at the annual meeting?

We are unaware of any matter to be presented at the annual meeting other than the proposals discussed in this proxy statement. If other matters are properly presented at the annual meeting, then the persons named in the proxy will have authority to vote all properly executed proxies in accordance with their judgment on any such matter.

What vote is required for each proposal?

Election of Directors. You may vote “FOR” or “AGAINST” a nominee for our Board of Directors or “ABSTAIN” from voting as to a nominee. Our Bylaws require that each director be elected by the majority of votes cast with respect to such director in uncontested elections. Therefore, in an uncontested election, each nominee who receives a majority of the votes cast (the number of shares voted “for” the nominee exceeds the number of votes cast “against” that nominee) will be elected, assuming a quorum is present. In a contested election, however, directors are instead elected by a plurality of the votes cast, meaning that the eightsix nominees receiving the most votes would be elected. You may not vote your shares cumulatively or for a greater number of persons than the number of nominees named

in this proxy statement. Abstentions and broker non-votes are not counted as votes cast and therefore will not have any effect on the outcome of this proposal.

RatificationApproval of Independent Registered Public Accounting Firmthe Company’s Amended 2008 Equity Incentive Plan. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the ratificationapproval of our selection of Ernst & Young LLPthe company’s 2008 Equity Incentive Plan, as our independent registered public accounting firm.amended. The affirmative vote of the majority of the shares present in person or represented by proxy at the meeting will be required for approval. Abstentions will have the same effect as if you voted against the proposal, and broker non-votes will not have any effect on the outcome of this proposal.

Ratification of Independent Registered Public Accounting Firm. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the ratification of our selection of Ernst & Young LLP as our independent registered public accounting firm. The affirmative vote of the majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required for approval. Abstentions will have the same effect as if you voted against the proposal, and broker non-votes, if any, will not have any effect on the outcome of this proposal.

Advisory Vote to Approve Named Executive Officer Compensation. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the non-binding advisory vote on named executive officer compensation. The affirmative vote of the majority of the shares of common stock represented in person or by proxy and entitled to vote at the meeting will be required for approval of this non-binding advisory vote. Abstentions will have the same effect as if you voted against the proposal, and broker non-votes will not have any effect on the outcome of this proposal. While the results of this advisory vote are non-binding, our compensation committee will consider the outcome of the vote in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for named executive officers.

Advisory Vote on Frequency of the Advisory Vote to Approve Named Executive Officer Compensation. In voting on this resolution, you may vote for one, two or three years based on your preference as to the frequency with which an advisory vote on named executive officer compensation should be held. If you have no preference, you may also vote to “ABSTAIN”. Abstentions will be counted towards the vote total, but will not be counted as a vote in favor of any of the frequency options, and thus will have the effect of reducing the likelihood that any frequency receives a majority vote, and broker non-votes will not have any effect on the outcome of this proposal. While the results of this advisory vote on the frequency with which an advisory vote on named executive officer compensation are non-binding, our Board of Directors and compensation committee will give careful consideration to the choice that receives the most votes when considering the frequency of future advisory votes on compensation of our named executive officers.

Advisory Vote to Approve Transfer Restrictions in the Company’s Amended and Restated Certificate of Incorporation. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the non-binding advisory vote on the transfer restrictions set forth in Article X of the company’s Amended and Restated Certificate of Incorporation attached as Annex A to this proxy statement. Abstentions will have the same effect as if you voted against the proposal, and broker non-votes will not have any effect on the outcome of this proposal. While the results of this advisory vote are non-binding, our Board of Directors will give careful consideration to the outcome of the vote in deciding whether any actions are necessary to address the concerns raised by the vote.

All shares entitled to vote and represented by properly completed proxies received prior to the meeting and not revoked will be voted at the meeting in accordance with your instructions. If you return a signed proxy card without indicating how your shares should be voted on a matter and do not revoke your proxy, the shares represented by your proxy will be voted as the Board of Directors recommends. If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may

constitute “broker non-votes” and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the meeting.

What are the recommendations of the Board of Directors?

The recommendation of our Board of Directors is set forth together with the description of each proposal in this proxy statement. In summary, our Board of Directors recommends a vote FOR the election of each of the named nominees for director, FOR the Amendments to the Company's 2008 Equity Incentive Plan, FORratification of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2017.2019. With respect to the advisory votes, our Board of Directors recommends a vote FOR the compensation of our named executive officers, SELECTone year as to the frequency of holding advisory votes on named executive officer compensation and FOR thetransfer restrictions in the company’s Amended and Restated Certificate of Incorporation.officers.

Where can I find the voting results?

The preliminary voting results will be announced at the meeting. The final voting results will be reported in a Current Report on Form 8-K, which will be filed with the SEC within four business days after the meeting. If our final voting results are not available within four business days after the meeting, we will file a Current Report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the Current Report on Form 8-K within four business days after the final voting results are known to us.

A NOTE REGARDING OUR PROXY STATEMENT

The company was incorporated in Delaware on April 28, 2016 in connection with the transactions contemplated by that certain Agreement and Plan of Merger, dated as of April 28, 2016, (the “Merger Agreement”), by and among TiVo, Rovi Corporation (“Rovi”), TiVo Inc. (now known as TiVo Solutions Inc.) (“TiVo Inc.”), Nova Acquisition Sub, Inc. and Titan Acquisition Sub, Inc. On September 7, 2016 (the “TiVo Acquisition Date”), the parties consummated the transactions whereby Nova Acquisition Sub, Inc. was merged with and into Rovi, and Titan Acquisition Sub, Inc. was merged with and into TiVo Inc., with each of Rovi and TiVo Inc. surviving their respective mergers as wholly owned subsidiaries of the company (collectively, the “Mergers”“TiVo Acquisition”).

Please note that unless indicated otherwise, the discussionsdiscussion in “Executive Compensation” and “Non-Employee Director Compensation” reflectreflects the disclosures of Rovi, and with respect to the period following the TiVo Acquisition Date, TiVo, as the successor registrant to Rovi, and with respect to certain disclosures in “Non-Employee Director Compensation,” TiVo Inc., for previous fiscal year(s).Rovi. These disclosures, which include descriptions of the practices and policies for each of Rovi (and TiVo, as the successor registrant to Rovi) and TiVo Inc., are provided for your information to the extent they relate to the company’s current executives and Board of Directors.executives.

|

|

| PROPOSAL 1: ELECTION OF DIRECTORS |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of nineseven members, a majority of whom are “independent” under applicable rules of the SEC. Our Bylaws provide that our Board of Directors shall have not less than five members, with the exact number of directors to be fixed from time to time by the Board of Directors.

The corporate governance and nominating committee seeks to assemble a Board of Directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the company’s business. To that end, the committee has identified and evaluated nominees in the broader context of the Board of Directors’ overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the corporate governance and nominating committee views as critical to effective functioning of the Board of Directors. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the committee to recommend that person as a nominee. Each corporate governance and nominating committee member may have a variety of reasons, however, for believing that a particular person would be an appropriate nominee for the Board of Directors, and these views may differ from the views of other members. Each of the nominees listed below is currently a director of the company who was previously elected by the stockholders, except for Messrs. Hinson and Moloney. In September 2016, in accordance with the terms of the Merger Agreement, Rovi’s board of directors and TiVo Inc.'s board of directors mutually agreed that Messrs. Hinson and Moloney would join the Board of Directors.stockholders.

In February 2017,March 2019, Mr. N. Steven LucasJeffrey T. Hinson notified the Board that he would not stand for re-election. Accordingly, and based on the above criteria, our corporate governance and nominating committee has recommended the eightsix individuals listed below to stand for election at the annual meeting of stockholders this year and our Board of Directors has approved the nomination of these eightsix directors to stand for election. Each director will be elected to serve until the next annual meeting of stockholders, or until a successor is duly elected and qualified or until the director’s earlier death, resignation or removal. Each nominee for director below has consented to be named in this proxy statement and has agreed to serve as a director if elected by the stockholders. If any nominee named in this proxy statement should become unable to serve or for good cause will not serve as a director prior to the meeting, our Board of Directors may designate a substitute nominee to fill the vacancy and proxies will be voted for that substitute nominee. If any such substitute nominee(s) are designated, we will file an amended proxy statement and proxy card that, as applicable, identifies the substitute nominee(s), discloses that such nominee(s) have consented to being named in the revised proxy statement and to serve if elected, and includes biographical and other information about such nominee(s) as required by the rules of the SEC.

There are no family relationships among our executive officers, directors and nominees for director.

Nominees for Director

You are being asked to vote on the eightsix director nominees listed below. Unless otherwise instructed, the proxy holders will vote the proxies received by them for these eightsix nominees. All of our nominees for director are current members of our Board of Directors.

|

| | | | | | |

| Name of Director Nominee | | Age | | Director Since* | | Position |

| Thomas Carson | | 57 | | 2011 | | Director; President and Chief Executive Officer |

| James E. Meyer | | 62 | | 1997 | | Chairman of the Board; Independent Director |

| Alan L. Earhart | | 73 | | 2008 | | Independent Director |

| Eddy W. Hartenstein | | 66 | | 2015 | | Independent Director |

| Jeffrey T. Hinson | | 62 | | 2007 | | Independent Director |

| Daniel Moloney | | 57 | | 2013 | | Independent Director |

| Raghavendra Rau | | 67 | | 2015 | | Independent Director |

| Glenn W. Welling | | 46 | | 2015 | | Independent Director |

| |

* | The “Director Since” column above denotes the year in which such member joined as a director of TiVo Corporation or one of its subsidiaries, Rovi Corporation, TiVo Inc., Rovi Solutions Corporation (formerly Macrovision Corporation) or Rovi Guides, Inc. (formerly Gemstar-TV Guide International, Inc. (“Gemstar”)). |

|

|

| PROPOSAL 1: ELECTION OF DIRECTORS |

|

| | | | | | |

| Name of Director Nominee | | Age | | Director Since* | | Position |

| Raghavendra Rau | | 69 | | 2015 | | Director; Interim President and Chief Executive Officer |

| James E. Meyer | | 64 | | 1997 | | Chairman of the Board; Independent Director |

| Alan L. Earhart | | 75 | | 2008 | | Independent Director |

| Eddy W. Hartenstein | | 68 | | 2015 | | Independent Director |

| Daniel Moloney | | 59 | | 2013 | | Independent Director |

| Glenn W. Welling | | 48 | | 2015 | | Independent Director |

*The “Director Since” column above denotes the year in which such member joined as a director of TiVo Corporation or one of its subsidiaries, Rovi, TiVo Inc., Rovi Solutions Corporation (formerly Macrovision Corporation) or Rovi Guides, Inc. (formerly Gemstar-TV Guide International, Inc. (“Gemstar”)).

|

| | |

Thomas Carson.Raghavendra Rau | Qualifications: Mr. Rau holds a bachelor's degree in engineering from the National Institute of Technology (Surathkal, India) and an MBA from the Indian Institute of Management (Ahmedabad). Mr. Rau serves on the Board of Quantum Corporation, a manufacturer of data storage devices, and served on the Board of Aviat Networks, a wireless networking company, from November 2010 to January 2015. We believe Mr. Rau brings extensive prior experience in the service provider industry, senior leadership experience including serving as a chief executive officer and valuable experience in the implementation of corporate strategy to the Board of Directors. |

| | • Mr. CarsonRau has served as our Interim President and Chief Executive Officer since July 2018 and as a member of our Board of Directors since December 2011.2015. • Mr. Carson previouslyRau served as Chief Executive Officer of SeaChange International Inc., a video software technology company, from November 2011 to October 2014 and was Executivea member of its Board from July 2010 until October 2014. • Mr. Rau has held a number of senior leadership positions with Motorola Inc. from 1992 to 2008, including Senior Vice President Worldwide Salesof Strategy and Business Development of the Networks & Marketing since May 2008 when the acquisition of Gemstar-TV Guide International by the company was completed. • From April 2006 to May 2008, Mr. Carson served in various capacities at Gemstar, includingEnterprise business, Senior Vice President of the North American IPGMobile TV Solutions business, and President for North American CE business.

• Prior to joining Gemstar, Mr. Carson held various executive positions at Thomson Multimedia Corporation (“Thomson”), including ExecutiveCorporate Vice President of Operational Efficiency programs, Executive Vice President, Global SalesMarketing and Services and Executive Vice President of Patents & Licensing.Professional Services.

|

| James E. Meyer | Qualifications: Mr. CarsonMeyer holds a B.S. in business administrationeconomics and an MBA from VillanovaSt. Bonaventure University. WeMr. Meyer currently serves on the Boards of Directors of SiriusXM and Charter Communications. With his years of managerial experience, both at Sirius and Thomson, we believe Mr. Carson is qualifiedMeyer brings to sit on our Board of Directors as he is our Presidentdemonstrated management ability at senior levels and Chief Executive Officer.critical industry, technology and operational insights.

Age: 57

Director since: 2011

|

| | |

James E. Meyer. | |

| | • Mr. Meyer has served as our Chairman of the Board since July 2015 and a member of our Board since May 2008. • Mr. Meyer has served as Chief Executive Officer of Sirius XM Radio since December 2012. • Mr. Meyer served as President of Sirius Satellite Radio from April 2004 to December 2012. • From 1997 to 2002, Mr. Meyer served in various capacities at Thomson. • Mr. Meyer served as a member of the Board of Directors of Gemstar from 1997 until May 2008. |

|

|

| PROPOSAL 1: ELECTION OF DIRECTORS |

|

| | |

| Alan L. Earhart | Qualifications:Mr. MeyerEarhart holds a B.S. in economics and an MBAaccounting from St. Bonaventure University. Mr. Meyer currently serves on the boardUniversity of directors of SiriusXM. WithOregon. From his years of managerial experience bothas a partner at Sirius and Thomson,a major accounting firm, we believe Mr. Meyer brings to our BoardEarhart has extensive knowledge of Directors demonstrated management ability at senior levelsaccounting issues and criticalvaluable experience dealing with accounting principles and financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of publicly-reporting companies, as well as technology industry technology and operational insights.insight.

Age: 62

Director since: 1997

|

| | |

Alan L. Earhart. | |

| | • Mr. Earhart retired as partner of PricewaterhouseCoopers LLP, an accounting and consulting firm, in 2001. At the time of his retirement, he served as Managing Partner for PricewaterhouseCoopers’ Silicon Valley office. • From 1970 to 2001, Mr. Earhart held a variety of positions with Coopers & Lybrand and its successor entity, PricewaterhouseCoopers LLP. |

| Eddy W. Hartenstein | Qualifications:Mr. EarhartHartenstein holds a B.S. in accountingaerospace engineering, a B.S. in mathematics and an honorary Doctor of Science from California State Polytechnic University, Pomona, and an M.S. in applied mechanics from the UniversityCalifornia Institute of Oregon.Technology. Mr. EarhartHartenstein currently serves onas the Boardlead independent director of DirectorsSirius XM Radio Inc. and as a director of NetApp, a computer storageBroadcom Corporation, an analog and data managementdigital semiconductor connectivity solutions company, and Brocade Communications Systems Inc., a data center networking solution company. From his experience as a partner at a major accounting firm, weTribune Publishing. We believe, Mr. Earhart has extensive knowledge of accounting issuesHartenstein’s experience in the media and valuable experience dealing with accounting principles and financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of publicly-reporting companies,service provider industries, senior leadership, as well as technologyhis previous operational experience, including serving as the chief executive officer, of large, complex, publicly-held companies brings technological and industry insight.expertise to our Board of Directors.

Age: 73

Director since: 2008

|

| | |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS |

|

| | |

Eddy W. Hartenstein. | |

| | • Mr. Hartenstein served as President and Chief Executive Officer of the Tribune Company, a multimedia, publishing, digital media and broadcasting company, from May 2011 to January 2013. • Mr. Hartenstein was also publisher and Chief Executive Officer of the Los Angeles Times from August 2008 to August 2014. • Previously, Mr. Hartenstein served as President of DIRECTV, Inc., a television service provider, from its inception in 1990 through 2001 and then as its Chairman and Chief Executive Officer from 2001 to 2003, when News Corporation purchased a controlling interest in the company. He continued as Vice Chairman of The DIRECTV Group until 2004. • Mr. Hartenstein was inducted into the Consumer Electronics Association Hall of Fame in 2008, the Broadcasting and Cable Hall of Fame in 2002 and the National Academy of Engineering in 2001, and received an Emmy® from the National Academy of Television Arts and Sciences for lifetime achievement in 2007. | Qualifications: Mr. Hartenstein holds a B.S. in aerospace engineering, a B.S. in mathematics and an honorary Doctor of Science from California State Polytechnic University, Pomona, and an M.S. in applied mechanics from the California Institute of Technology. Mr. Hartenstein currently serves as the lead independent director of Sirius XM Radio Inc. and as a director of Broadcom Corporation, an analog and digital semiconductor connectivity solutions company, City of Hope, a private, not-for-profit clinical research center, hospital and medical school, Tribune Publishing and SanDisk Corporation, a flash memory storage device and software company. We believe, Mr. Hartenstein’s experience in the media and service provider industries, senior leadership, as well as his previous operational experience, including serving as the chief executive officer, of large, complex, publicly-held companies brings technological and industry expertise to our Board of Directors.

Age: 66

Director since: 2015

|

| | |

Jeffrey T. Hinson. | |

| • Mr. Hinson has served as President of YouPlus Media L.L.C., an online video content marketing company, since June 2009.

• From July 2007 to July 2009, Mr. Hinson served as Chief Executive Officer of Border Media Partners.

• Mr. Hinson was an independent Financial Consultant from January 2006 to June 2007.

• From March 2004 to June 2005, Mr. Hinson served as Executive Vice President and Chief Financial Officer of Univision Communications, a Spanish language media company.

• Previously, Mr. Hinson served as Senior Vice President and Chief Financial Officer of Univision Radio, the radio division of Univision Communications, from September 2003 to March 2004, and later, as a consultant to Univision Communications, from June 2005 to December 2005.

Daniel Moloney | Qualifications: Mr. HinsonMoloney holds a BBAbachelor’s degree in engineering from the University of Texas at AustinMichigan and an MBA from the University of Texas Business School.Chicago. Mr. HinsonMoloney currently serves as chairmanon the Board of the boardDirectors of directors of Windstream Corporation, a provider of voice and data network communications, and as a director of Live Nation Entertainment,Plantronics Inc., a global entertainment company.communications solutions provider. He also serves on the Boards of Directors of Stratus Technologies and Digital River. We believe Mr. Hinson has extensive financial and accountingMoloney’s nearly 30 years of experience thatin providing leading technology to the cable industry will provide valuable insight to our Board of Directors.unique Age: 62

Director since: 2007

|

| | |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS |

|

| | |

Daniel Moloney. | |

| | • Mr. Moloney has served as Executive Partner of Siris Capital Group, LLC, a technology/telecom focused private equity company, since November 2013. • Mr. Moloney served as President of Motorola Mobility, Inc., a consumer electronics and telecommunications company, from September 2010 until June 2012. • From April 2010 to August 2010, Mr. |

|

|

| PROPOSAL 1: ELECTION OF DIRECTORS |

|

| | |

| Moloney served President and Chief Executive Officer of Technitrol, Inc. • Mr. Moloney served as Executive Vice President and President, Home and Networks Mobility of Motorola, Inc. from April 2007 until March 2010. • From June 2002 to March 2007, Mr. Moloney served as Executive Vice President and President, Connected Home Solutions of Motorola, Inc. | Qualifications: Mr. Moloney holds a bachelor’s degree in engineering from the University of Michigan and an MBA from the University of Chicago. Mr. Moloney currently serves on the boards of directors of Stratus Technologies, Polycom and Digital River. He also serves on the board of The Cable Center, an industry non-profit company. We believe Mr. Moloney’s nearly 30 years of experience in providing leading technology to the cable industry will provide unique contributions to our Board of Directors.

Age: 57

Director since: 2013

|

| | |

Raghavendra Rau. | |

| Glenn W. Welling | •Qualifications: Mr. RauWelling holds a B.S. in economics from the University of Pennsylvania. Mr. Welling has served as Chief Executive Officeron the Board of SeaChange InternationalDirectors of Hain Celestial, a natural and organic food company, since September 2017. He was previously a member of the Board of Directors of Jamba, Inc. from 2015 until its acquisition in 2018, and Medifast, Inc., a video software technology company,manufacturer and distributor of healthy living products and programs, from November 20112015 to October 2014 and was a member of its board from July 2010 until October 2014.

• Mr. Rau has held a number of senior leadership positions with Motorola Inc. from 1992 to 2008, including Senior Vice President of Strategy and Business Development of the Networks & Enterprise business, Senior Vice President of the Mobile TV Solutions business, and Corporate Vice President of Marketing and Professional Services.

| Qualifications: Mr. Rau holds a bachelor's degree in engineering from the National Institute of Technology (Surathkal, India) and an MBA from the Indian Institute of Management (Ahmedabad). Mr. Rau served on the board of Aviat Networks, a wireless networking company, from November 2010 to January 2015, and on the board of Microtune, Inc., a silicon and subsystems company from May 2010 to December 2010.2018. We believe Mr. RauWelling brings extensive prior experience in the service provider industry, senior leadership experience including serving as a chief executive officer and valuable experience in the implementation of corporate strategyfinancial expertise to theour Board of Directors.

Age: 67

Director since: 2015

|

| | |

Glenn W. Welling. | |

| | • Mr. Welling has been the Chief Investment Officer and Principal of Engaged Capital, LLC since its founding in 2012. • Prior to founding Engaged Capital, Mr. Welling was a principal and managing director of research at Relational Investors, LLC, which he joined in July 2008 and was responsible for the research in the equity fund's consumer, healthcare and utility group. • FormFrom February 2002 to May 2008, Mr. Welling was a Managing Director of Credit Suisse Group AG, where he also served as the Head of the Investment Banking Department’s Advisory Business. | Qualifications: Mr. Welling holds a B.S. in economics from the University of Pennsylvania. Mr. Welling has been a member of the board of directors of Jamba, Inc., a leading restaurant retailer of better-for-you food and beverage offerings, since January 2015 and on the board of Medifast, Inc., a manufacturer and provider of weight-loss and healthy living products and programs, since June 2015. We believe Mr. Welling brings extensive financial expertise to our Board of Directors.

Age: 46

Director since: 2015

|

|

|

PROPOSAL 1: ELECTION OF DIRECTORS |

Required Vote and Board Recommendation

Our Bylaws require that each director be elected by the majority of votes cast with respect to such director in uncontested elections. The election of directors pursuant to this Proposal is an uncontested election, and, therefore, the majority vote standard will apply. Therefore, each nominee who receives a majority of the votes cast (the number of shares voted “for” the nominee exceeds the number of votes cast “against” that nominee) will be elected, assuming a quorum is present. You may vote “for” a nominee for our Board of Directors, you may vote “against” a nominee, or you may “abstain” from voting as to a nominee. You may give each candidate one vote for each share you held on the record date. You may not vote your shares cumulatively or for a greater number of persons than the number of nominees named in this proxy statement. If a nominee receives a greater number of votes “against” from his or her election than votes “for” such nominee, such nominee shall offer to tender his or her resignation to the Board in accordance with our Bylaws. Abstentions and broker non-votes are not counted as votes cast and therefore will not have any effect on the outcome of this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINATED DIRECTORS.

|

|

| PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 Equity Incentive Plan |

PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 EQUITY INCENTIVE PLAN

At the meeting, stockholders will be asked to approve the company’s 2008 Equity Incentive Plan (the “2008 Equity Plan”), as amended. The 2008 Equity Plan (which was originally named the Rovi Corporation 2008 Equity Incentive Plan) was originally approved by the Board of Directors of Rovi Corporation (“Rovi”) on June 9, 2008 and by the stockholders of Rovi on July 15, 2008 and has been subsequently amended in 2011, 2013, 2014 and 2016, as described more in detail below. On September 7, 2016, in connection with the TiVo Acquisition, the 2008 Equity Plan was assumed by the company and all shares of Rovi’s common stock subject to the 2008 Equity Plan were converted to shares of the company’s common stock.

Subject to stockholder approval, the company’s Board approved an amendment of the 2008 Equity Plan on March 14, 2019 to make certain material changes (the 2008 Equity Plan, as amended, the “Amended 2008 Equity Plan”). The Amended 2008 Equity Plan includes the following material changes to the 2008 Equity Plan, as described in more detail under “Summary of the Amended 2008 Equity Plan” below:

revise the name of the plan to be the TiVo Corporation 2008 Equity Incentive Plan;

increase the aggregate number of shares of the company’s common stock authorized for issuance under the Amended 2008 Equity Plan by 5,000,000 shares; and

provide that the Amended 2008 Equity Plan will be the successor to and continuation of the TiVo Corporation Titan Equity Incentive Award Plan (the “TiVo Prior Plan”) so that (i) following August 6, 2018 (the termination date of the TiVo Prior Plan), no new awards will be granted under the TiVo Prior Plan, and (ii) as of the date of the 2019 annual meeting, shares that are subject to outstanding stock awards granted under the TiVo Prior Plan that (a) expire or terminate, (b) are forfeited due to a failure to vest, or (c) with respect to any full value award (i.e., any award other than a stock option or stock appreciation right), are reacquired or withheld (or not issued) to satisfy tax withholding obligations, will become available for issuance under the Amended 2008 Equity Plan.

The 2008 Equity Plan is used to issue stock options and other equity awards to company employees, management, non-employee directors and other service providers in order to incent and reward superior performance in achieving the company’s long-term objectives, with the attendant rewards aligning with increased stockholder value as expressed in higher share prices. The purpose of the 2008 Equity Plan is to allow the company to compete with other technology companies for employees, non-employee directors and other service providers in Silicon Valley and other competitive labor markets where the company and its subsidiaries operate. The proposed authorized share increase and other changes in the Amended 2008 Equity Plan will help ensure that a sufficient reserve of common stock remains available under the Amended 2008 Equity Plan to allow us to continue to provide equity incentives to our key employees and service providers on a competitive level determined appropriate by our compensation committee, while also implementing compensation and corporate governance best practices. The Amended 2008 Equity Plan will also allow us to utilize a broad array of equity incentives in order to secure and retain the services of our employees and service providers, and to provide long term incentives that align the interests of our employees and service providers with the interests of our stockholders. The company must be able to continue to offer equity

|

|

| PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 Equity Incentive Plan |

compensation to attract, motivate and retain highly qualified employees, non-employee directors and other service providers. While the company’s Board cannot be absolutely certain of the rate at which the available shares under the Amended 2008 Equity Plan will be utilized, the company expects that the increased share reserve will be sufficient to meet the company’s needs over the next couple of years.

If this proposal is approved by our stockholders, the Amended 2008 Equity Plan will become effective upon the date of the 2019 annual meeting. In the event that our stockholders do not approve this proposal, the Amended 2008 Equity Plan will not become effective and the 2008 Equity Plan will continue in its current form.

Summary of the Amended 2008 Equity Plan

General. The 2008 Equity Plan was originally approved by the Board of Directors of Rovi on June 9, 2008 and by the stockholders of Rovi on July 15, 2008. On March 22, 2011, the Board of Directors of Rovi approved an amendment of the 2008 Equity Plan to allow the chief executive officer of Rovi to participate in the 2008 Equity Plan, which was approved by the stockholders of Rovi on May 24, 2011. On February 12, 2013, the Board of Directors of Rovi approved several amendments to the 2008 Equity Plan, including among other amendments: (i) a 4,500,000 share increase to the aggregate number of shares of Rovi’s common stock authorized for issuance under the 2008 Equity Plan; (ii) that the 2008 Equity Plan would be the successor to and continuation of the Rovi Corporation 2000 Equity Incentive Plan and the Sonic Solutions 2004 Equity Compensation Plan (together, the “Rovi Prior Plans”) so that as of April 30, 2013, no new awards would be granted under the Rovi Prior Plans, the shares then remaining available for grant under the Rovi Prior Plans became available for grant under the 2008 Equity Plan, and shares that were subject to outstanding stock awards granted under the Rovi Prior Plans that expire or terminate or are forfeited become available for grant under the 2008 Equity Plan; and (iii) for purposes of the requirements of Section 162(m) of the Code, confirm (A) the applicable award limits, (B) existing performance criteria upon which performance goals may be based with respect to performance awards under the 2008 Equity Plan, and (C) existing means of adjustment when calculating the attainment of performance goals for performance awards granted under the 2008 Equity Plan (collectively, the “Section 162(m) provisions”). The stockholders of Rovi approved these amendments on April 30, 2013. On March 10, 2014, the Board of Directors of Rovi approved an amendment of the 2008 Equity Plan to increase the aggregate number of shares of Rovi’s common stock authorized for issuance under the 2008 Equity Plan by 1,500,000. The stockholders of Rovi approved this amendment on April 29, 2014. On March 8, 2016, the Board of Directors of Rovi approved an amendment of the 2008 Equity Plan to: (i) increase the aggregate number of shares of Rovi’s common stock authorized for issuance under the 2008 Equity Plan by 6,000,000 shares; (ii) provide that the number of shares available for issuance under the 2008 Equity Plan will be reduced by 2.0 shares for each share issued pursuant to a full value award granted under the 2008 Equity Plan; (iii) adopt minimum vesting requirements, under which no stock option or stock appreciation right ("SAR") will be granted that vests until at least 12 months following the date of grant of the award, provided that up to 5% of the aggregate number of shares that may be issued under the 2008 Equity Plan may be subject to stock options and SARs which do not meet such vesting requirements; (iv) approve the Section 162(m) provisions; and (v) add a limitation on the total annual compensation that may be paid or granted to any non-employee director with respect to such service. The stockholders of Rovi approved this amendment on April 27, 2016.

A copy of the Amended 2008 Equity Plan is attached to the electronic version of this proxy statement filed with the SEC as Annex A, but you can also request a copy of the

|

|

| PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 Equity Incentive Plan |

Amended 2008 Equity Plan by writing to the company to the attention of Investor Relations. The following description of the Amended 2008 Equity Plan is a summary and therefore is qualified by reference to the complete text of the Amended 2008 Equity Plan.

The purpose of the Amended 2008 Equity Plan is to provide the company’s employees, non-employee directors and other service providers an opportunity to acquire or increase their ownership stake in the company, creating a stronger incentive to expend maximum effort for the company’s growth and success and encouraging its management, employees, non-employee directors and other service providers to continue their employment or service relationships with the company. Stock options and other stock awards, including restricted stock, restricted stock units, SARs and performance shares, may be granted under the Amended 2008 Equity Plan. Options granted under the Amended 2008 Equity Plan will be nonstatutory stock options, as the company has not granted any “incentive stock options” (as defined in Section 422 of the Code) under the 2008 Equity Plan and incentive stock options may not be granted under the Amended 2008 Equity Plan after July 15, 2018.

Administration. The compensation committee administers the Amended 2008 Equity Plan. The compensation committee approves who will be granted awards, the date of grants of awards and the terms and provisions of each award (which need not be identical).

Eligibility. The company’s employees, consultants and independent contractors, and non-employee directors, and those of the company’s subsidiaries, are eligible to receive awards under the Amended 2008 Equity Plan. As of March 11, 2019, all of the company’s and the company’s subsidiaries’ approximately 1,698 employees, 944 consultants and independent contractors, and 5 non-employee directors are eligible to participate in the Amended 2008 Equity Plan. Mr. Jeffrey T. Hinson, who is not standing for re-election when his term expires at the 2019 annual meeting of our stockholders, will not be eligible to receive awards under the Amended 2008 Equity Plan.

Securities Subject to Amended 2008 Equity Plan. The 2008 Equity Plan currently authorizes up to 28,149,817 shares for issuance under our general share pool. As of March 11, 2019, approximately 10,812,163 shares of common stock (which does not include any shares that might in the future be returned to the 2008 Equity Plan as a result of cancellation or expiration of awards) remain available for future grants under the 2008 Equity Plan, and awards covering 3,103,697 shares of common stock were outstanding under the 2008 Equity Plan. If the Amended 2008 Equity Plan is approved by our stockholders under this Proposal 2, an additional 5,000,000 shares will be available for future grants, so that a total of 33,149,817 shares of common stock would be authorized for issuance under the Amended 2008 Equity Plan. Available shares may be granted as stock options, SARs, restricted stock, restricted stock units or performance shares. This maximum number does not include the number of shares subject to outstanding stock awards granted under the Rovi Prior Plans or the TiVo Prior Plan (together, the “Prior Plans”) that (i) expire or terminate, (ii) are forfeited due to a failure to vest, or (iii) with respect to any full value award, are reacquired or withheld (or not issued) to satisfy tax withholding obligations (collectively, the “Prior Plans’ Returning Shares”). The Prior Plans’ Returning Shares will become available for issuance for new awards under the Amended 2008 Equity Plan.

|

|

| PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 Equity Incentive Plan |

The following table summarizes certain information regarding our equity incentive program.

|

| |

| As of March 11, 2019 |

| Total number of shares of common stock subject to outstanding stock options | 1,210,220 |

| Total number of shares of common stock subject to outstanding full value awards | 5,305,114 |

| Weighted-average exercise price of outstanding stock options | $23.38 |

| Weighted-average remaining term of outstanding stock options | 1.25 years |

| Total number of shares of common stock available for grant under the 2008 Equity Plan | 10,812,163 |

| Total number of shares of common stock available for grant under other equity incentive plans | — |

| Per-share closing price of common stock as reported on Nasdaq Global Select Market | $9.55 |

| Total number of shares of common stock outstanding | 124,905,466 |

Under the Amended 2008 Equity Plan, if any shares subject to an award granted under the Amended 2008 Equity Plan are not issued or forfeited because of the failure to vest or such an award expires or otherwise terminates without all of the shares covered by such award having been issued, or any shares subject to such an award are reacquired or withheld (or not issued) by the company to satisfy tax withholding obligations in connection with a full value award, such shares will again become available for issuance under the Amended 2008 Equity Plan. For purposes of this Proposal 2, such shares are collectively referred to as the “Amended 2008 Equity Plan Returning Shares”. However, the following shares will not become available again for issuance under the Amended 2008 Equity Plan: (i) any shares subject to an award granted under the Amended 2008 Equity Plan, or a stock option or SAR granted under the Prior Plans, that are not delivered because the award is exercised through a reduction of shares subject to the award (i.e., “net exercised”); (ii) any shares reacquired or withheld (or not issued) by the company to satisfy tax withholding obligations upon the exercise of a stock option or SAR granted under the Amended 2008 Equity Plan or the Prior Plans; (iii) any shares used as consideration for the exercise of a stock option or SAR granted under the Amended 2008 Equity Plan or the Prior Plans; and (iv) any shares repurchased by the company on the open market with the proceeds of the exercise price of a stock option or SAR granted under the Amended 2008 Equity Plan or the Prior Plans.

The Amended 2008 Equity Plan also provides that the number of shares available for issuance under the Amended 2008 Equity Plan will be reduced by (i) one share for each share of common stock issued pursuant to a stock option or SAR granted under the Amended 2008 Equity Plan, and (ii) 2.0 shares for each share of common stock issued pursuant to any other type of stock award granted under the Amended 2008 Equity Plan. For each Amended 2008 Equity Plan Returning Share or Prior Plans’ Returning Share that is subject to a full value award, the share reserve will increase by 2.0 shares.

Section 162(m) Transition Relief for Performance-Based Compensation. Section 162(m) of the Code generally disallows a tax deduction to a public company for compensation in excess of $1 million paid in a year to any of the company’s “covered employees” (as defined under Section 162(m) of the Code). Certain provisions in the Amended 2008 Equity Plan refer to the

|

|

| PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 Equity Incentive Plan |

“performance-based compensation” exception to the $1 million deductibility limit under Section 162(m) of the Code. Pursuant to the Tax Cuts and Jobs Act, this exception was repealed with respect to taxable years beginning after December 31, 2017. However, an award may still be eligible for this exception if, among other requirements, it is intended to qualify, and is eligible to qualify, as “performance-based compensation” under Section 162(m) of the Code pursuant to the transition relief provided by the Tax Cuts and Jobs Act for remuneration provided pursuant to a written binding contract which was in effect on November 2, 2017 and which was not modified in any material respect on or after such date. For purposes of this Proposal 2, the term “Section 162(m) Transition Relief” refers to such transition relief. Accordingly, the provisions in the Amended 2008 Equity Plan which refer to the “performance-based compensation” exception under Section 162(m) of the Code will only apply to any award that is intended to qualify, and is eligible to qualify, as “performance-based compensation” under Section 162(m) of the Code pursuant to the Section 162(m) Transition Relief and, therefore, such provisions are not applicable to any other awards granted under the Amended 2008 Equity Plan. However, even if an award is intended to qualify as “performance-based compensation” under Section 162(m) of the Code, no assurance can be given that the award will in fact qualify for the Section 162(m) Transition Relief or the “performance-based compensation” exception under Section 162(m) of the Code.

Annual Per-Participant Limitations. The Amended 2008 Equity Plan provides that (i) no awardee may be granted stock options or SARs covering more than 1,500,000 shares in any calendar year and (ii) no awardee may be granted performance-based awards intended to qualify as “performance-based compensation” under Section 162(m) of the Code covering more than 1,500,000 shares in any calendar year. However, in order to qualify as “performance-based compensation” under Section 162(m) of the Code, among other requirements, any such performance-based awards must be eligible to qualify for the Section 162(m) Transition Relief (as described in “Section 162(m) Transition Relief for Performance-Based Compensation” above).

Non-Employee Director Limitation. The aggregate value of all compensation paid or granted to any non-employee director for services on the Board with respect to any fiscal year (beginning with 2016), including awards granted under the Amended 2008 Equity Plan and cash fees paid by us to such non-employee director, shall not exceed $700,000 in total value, calculating the value of any equity awards based on the grant date fair value of such awards for financial reporting purposes. The Board may make exceptions to this limit in extraordinary circumstances, as the Board determines in its discretion, provided that the director who is granted or paid such additional compensation may not participate in the decision to grant or pay such compensation.

Minimum Vesting. Under the Amended 2008 Equity Plan, no stock option or SAR award granted on or after the date of the 2016 annual meeting may vest (or, if applicable, be exercisable) until at least 12 months following the date of grant of the award; provided, however, that up to 5% of the shares authorized for issuance under the Amended 2008 Equity Plan may be subject to stock options or SAR awards granted on or after the date of the 2016 annual meeting which do not meet such vesting (and, if applicable, exercisability) requirements.

Terms and Conditions of Options. Each option is evidenced by a stock option agreement between the company and the optionee and is subject to the following additional terms and conditions:

Exercise Price. The exercise price per share in the case of any option granted under the Amended 2008 Equity Plan may not be less than 100% of the fair market value of the common

|

|

| PROPOSAL 2: APPROVAL OF THE COMPANY’S AMENDED 2008 Equity Incentive Plan |